Bimonthly paycheck calculator

Calculate hourly employee pay. If you are paid in part based on how many days are in each month then.

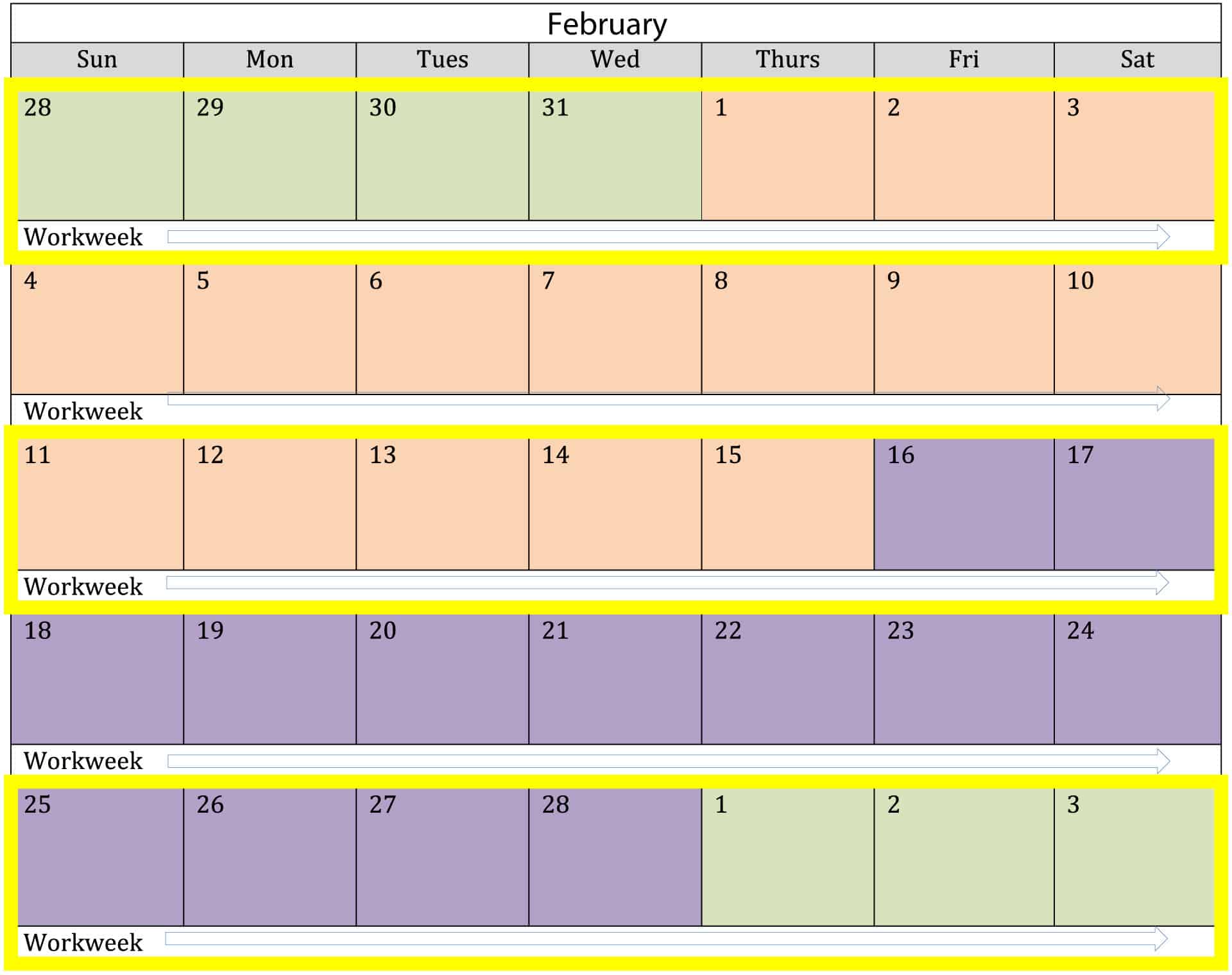

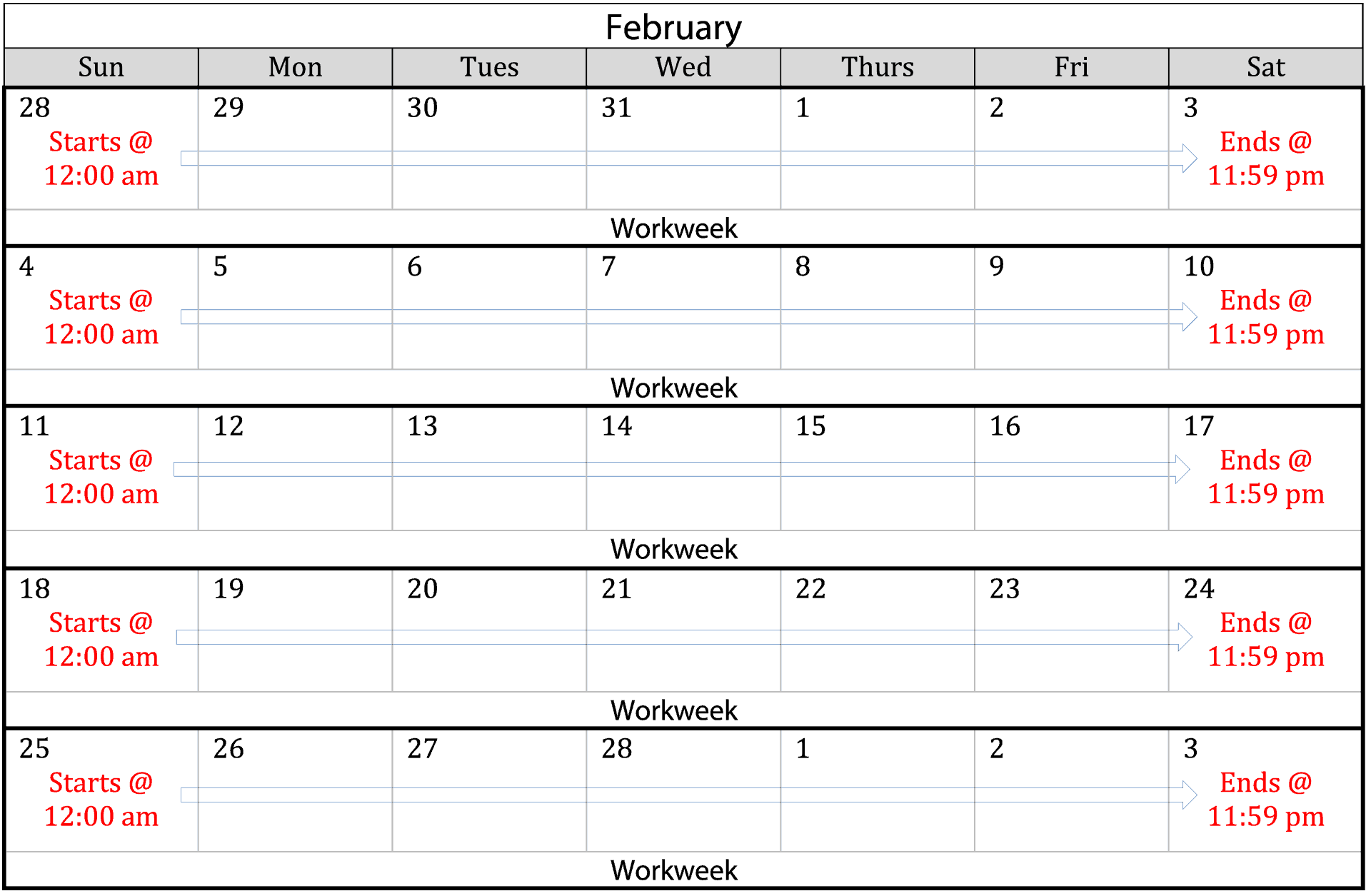

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

If you get paid bimonthly or.

. Subtract any deductions and. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Determine how many hours each employee worked over the period then multiply the hours worked by the rate per hour for that employee.

For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period.

This means you run payroll once every two weeks on consistent days of the week eg Fridays. Important note on the salary paycheck calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

A biweekly pay schedule means employees receive 26 paychecks per year. Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee. Some states follow the federal tax.

Bi-Monthly Payment Calculator The payment option commonly called bi-monthly is a bi-weekly payment option. Also a bi-weekly payment frequency generates. If you get paid biweekly you can divide 40000 by 26 pay periods to get approximately 1538 in gross wages every other week.

The calculator is updated with the tax. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 24.

If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in a year to. However some lenders offer a bi-monthly payment service to homebuyers. Usage of the Payroll Calculator.

You can use the calculator to compare your salaries between 2017 and 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Difference between gross pay and net pay.

The state tax year is also 12 months but it differs from state to state.

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

After Tax Income Calculator Deals 50 Off Www Ipecal Edu Mx

Pay Calculator

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Annual Salary To Biweekly Paycheck Conversion Calculator

Here S How Much Money You Take Home From A 75 000 Salary

Hourly To Annual Salary Calculator How Much Do I Make A Year

Elaws Flsa Overtime Calculator Advisor

Payroll Calculator Free Employee Payroll Template For Excel

New York Paycheck Calculator Adp

Smartasset Paycheck Calculator Flash Sales 59 Off Www Naudin Be

Oklahoma Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

Payroll Calculator With Pay Stubs For Excel

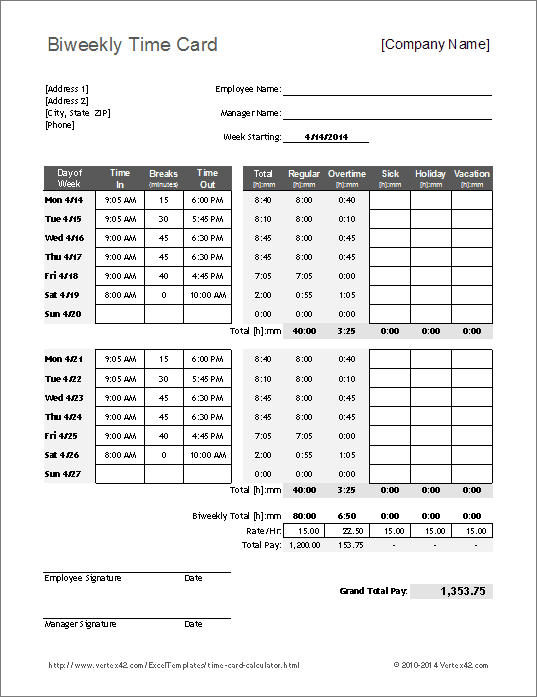

Free Time Card Calculator Timesheet Calculator For Excel